B2C

Fintech

Mobile App

Leveraging a 67% drop-off in the primary app to design a new retention-focused product.

Empowering agents to provide financial access to credit-invisible customers through a streamlined, credit-building card solution.

Industry

Fintech

Role

Product Designer, Growth

Owned end-to-end product design

Timeline

Q4 2021 - 4 months project

Went live in February 2022

Team

Product Designer (me), 1 Founder, 1 Data, 2 Product Managers, 4 Engineers

Overview

Context of the application

What Product?

A platform designed for financial agents to educate, promote, and distribute financial products to underserved markets.

Who is it for?

Rural, underserved populations with limited access to essential financial services, including bank accounts, loans, and credit instruments.

Why does it exist?

In India, over 700 million individuals globally remain 'credit invisible,' lacking access to modern financial tools and credit-building opportunities.

Problem

Problem in the Journey

😇

🙂

☺️

😍

😎

😫

33%

67%

1

2

3

4

5

Stages

User Activity

Enter Customer Details

Complete KYC

Check Eligible Products

Share Link

Complete Sale

Illustration of user behavior across typical events

User Problem

On average, 67% of end customers see zero eligible products in the credit card segment, leading to significant user friction.

Business Problem

This results in substantial revenue loss and erosion of user trust. If left unresolved, it poses a critical risk to the company's sustainability.

Why?

India is a debit-first economy, with a large population lacking credit history, resulting in limited product eligibility.

APPROACh

Balancing User Needs with Business Goals

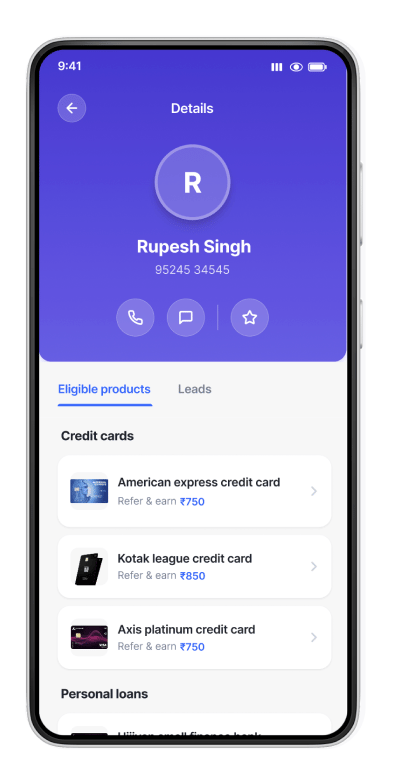

The core challenge was deciding how much market transparency to provide. Should we show all available credit card options, or focus exclusively on our own product? I explored three approaches to find the right balance.

1

UX-First Approach

Concept: Show all available credit cards from across the market, giving users complete transparency and freedom of choice.

✓ Maximizes user trust through transparency

✓ Empowers users with complete market knowledge

✗ Low conversion to our proprietary product

✗ Users may leave the platform entirely

3

Business-First Approach

Concept: Show only our proprietary credit card, focusing entirely on ecosystem retention and maximizing revenue from our own product.

✓ Maximum focus on proprietary product

✓ Keeps users within our ecosystem

✗ Continues the 67% drop-off problem

✗ Erodes user trust when they're not eligible

2

Balanced Approach — The Sweet Spot

Concept: Highlight our proprietary credit card prominently while still showing competitive alternatives. This maintains transparency while guiding users toward our ecosystem.

✓ Builds trust through market transparency

✓ Guides users to our product without forcing

✓ Higher conversion while maintaining user satisfaction

✓ Reduces drop-off by showing alternatives when our product isn't eligible

Why this won: This approach reduced the 67% drop-off significantly by ensuring users always saw relevant options, while still achieving strong conversion to our proprietary product through strategic prominence and positioning.

✓ Selected Approach

Illustration of user behavior across typical events

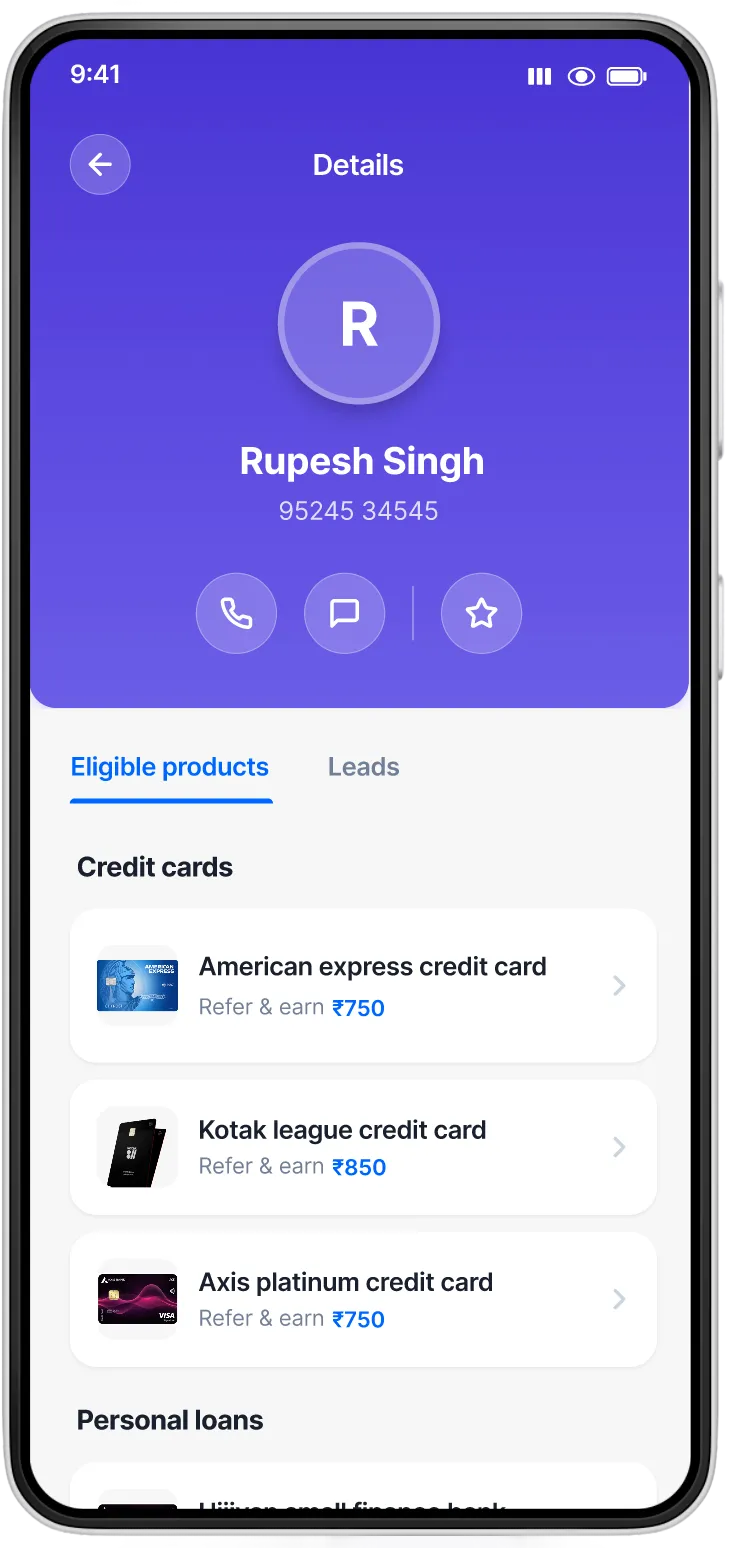

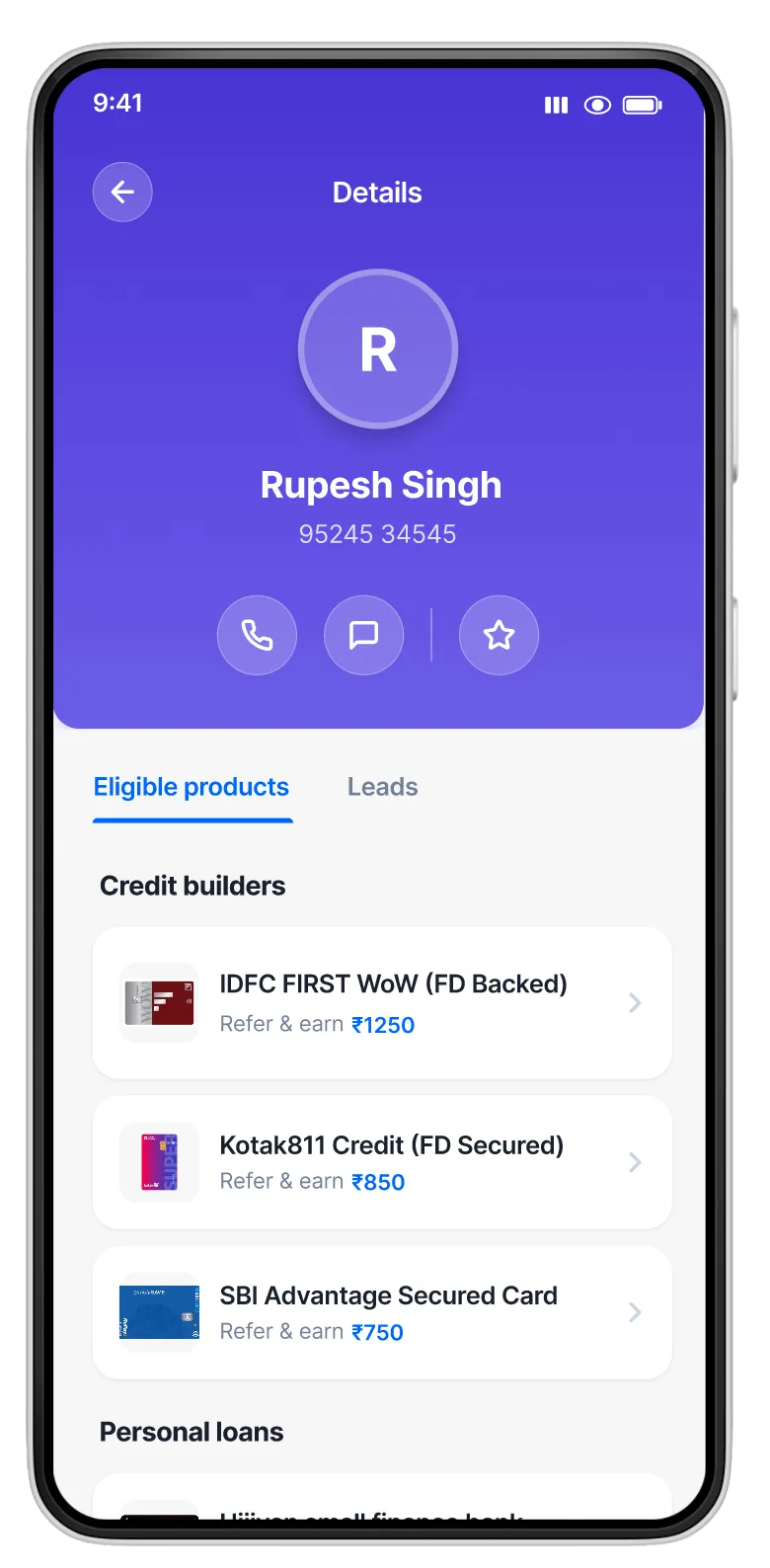

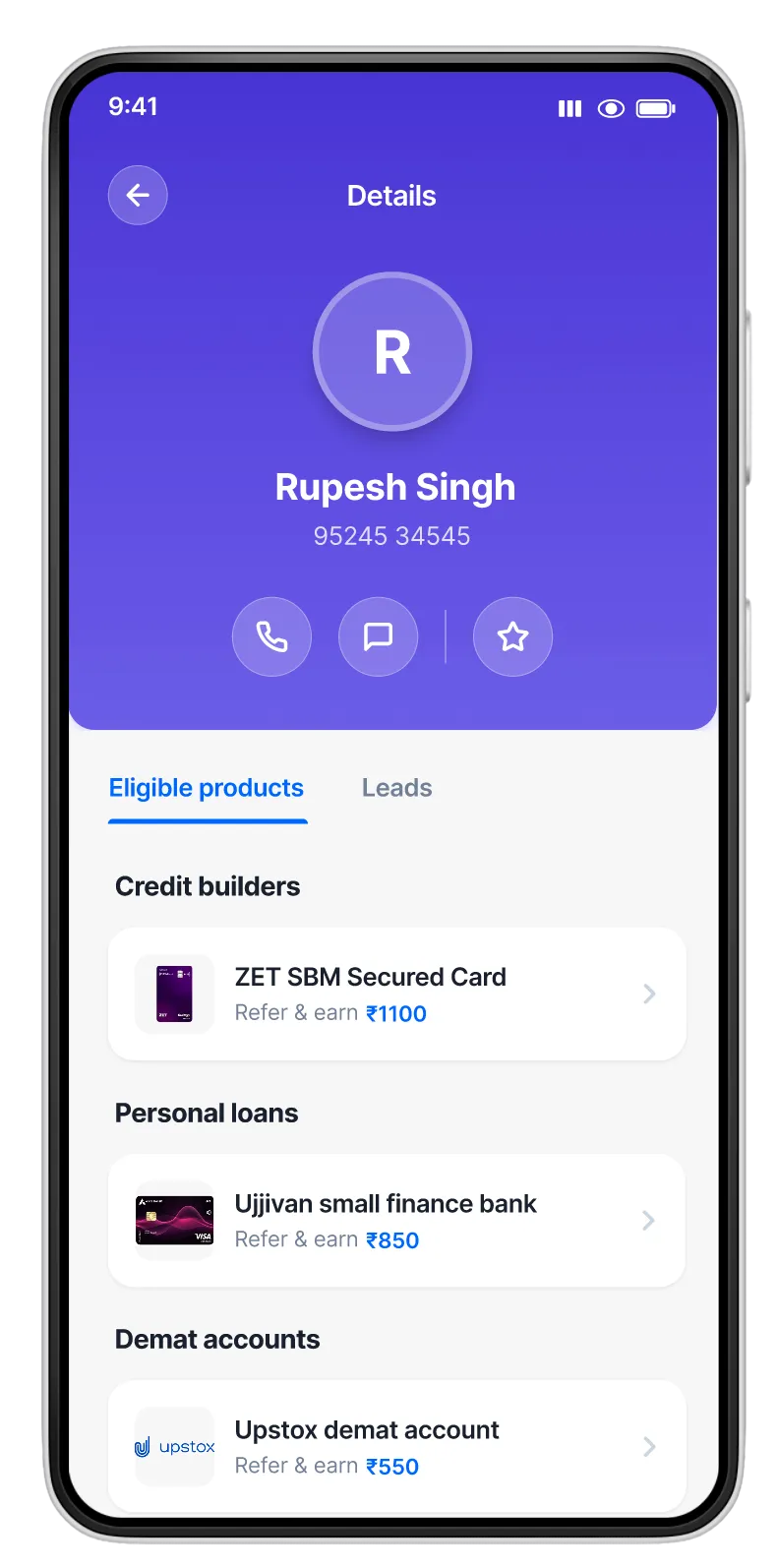

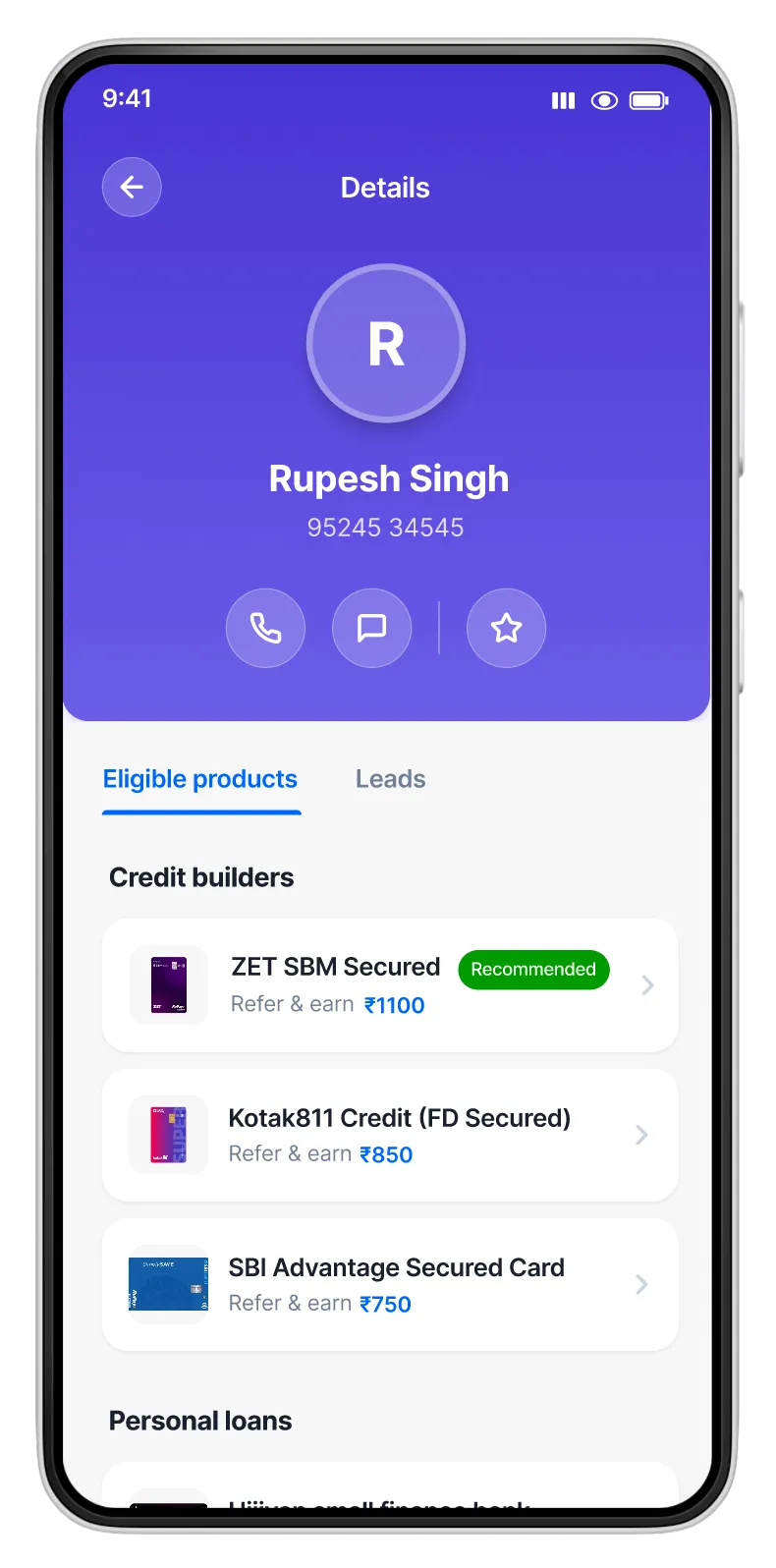

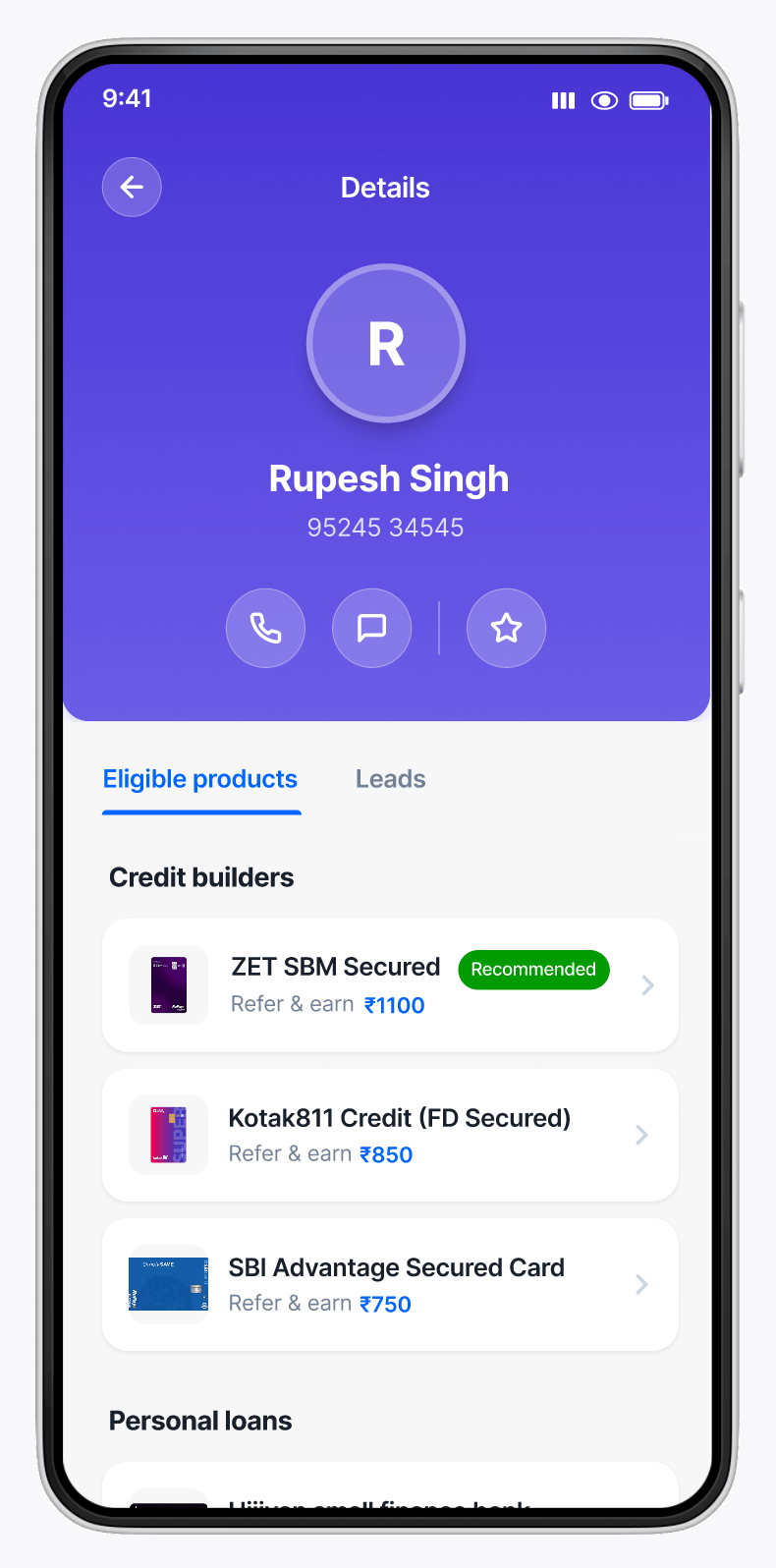

final design

From Drop-off to Opportunity

Instead of leaving 67% of users empty-handed, we transformed the moment of ineligibility into an opportunity for credit building—creating a win-win for users and business.

The Transformation

Before

Dead End Experience

• No credit card options available

• 67% of users hit this dead end

• Zero pathway to credit building

• Massive drop-off and lost revenue

After

Credit Builder Opportunity

• Secured credit cards for credit building

• Pathway to establish credit history

• Alternative options always visible

• Reduced drop-off, increased trust

design process

Turning a Problem into an Opportunity

When 67% of users hit a dead-end, we saw an opportunity to build something new—a credit-building pathway that would serve both users and business goals. Here's how we transformed this drop-off into a new product offering.

01

Problem Discovery

Analyzed user behavior data and identified that 67% of users were dropping off when checking for eligible credit card products. This massive friction point was costing us revenue and trust.

Data Analysis

User journey tracking & drop-off rates

Stakeholder Interviews

Understanding business constraints

02

Understanding Credit-Invisible Users

Dove deep into why users were ineligible. Discovered that India's debit-first economy left millions without credit history, making them "credit-invisible" and unable to access traditional credit products.

User Research

Agent interviews & customer profiles

Market Analysis

Credit landscape & secured card options

03

Exploring Solutions

Collaborated with product and business teams to explore multiple approaches. The key question: How much transparency should we provide while still driving business value? This led to three distinct design directions.

Approach 1

Full market transparency

Approach 2 ✓

Balanced guidance

Approach 3

Business-first focus

04

Designing the Credit Builder Pathway

Created a new product experience featuring secured credit cards (FD-backed) for credit-invisible users. Designed the UI to prominently feature our proprietary solution while maintaining transparency with market alternatives.

Wireframing

Information architecture & card hierarchy

Visual Design

High-fidelity mockups & prototypes

05

Testing & Iteration

Conducted UAT sessions with financial agents to validate the experience. Iterated on messaging, card prominence, and information clarity based on feedback to ensure the solution was both intuitive and effective.

User Testing

Agent feedback & usability sessions

Iterations

Refinements based on real-world usage

06

Launch & Impact

Shipped the new credit-building feature in February 2022. The solution successfully reduced drop-off by 55%, increased secured card conversions by 3.2x, and achieved an 89% user satisfaction score.

Result

Transformed drop-off into opportunity

launch

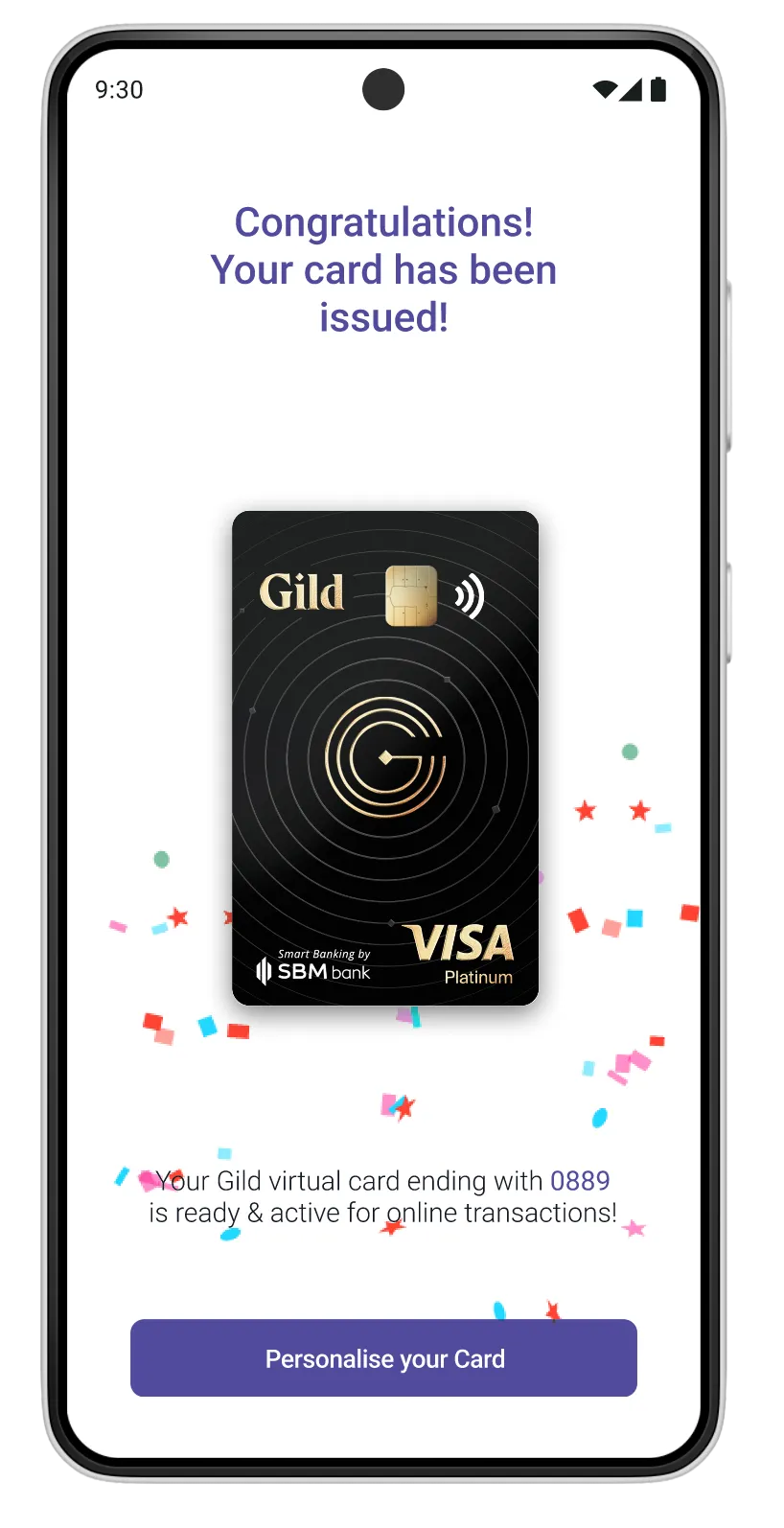

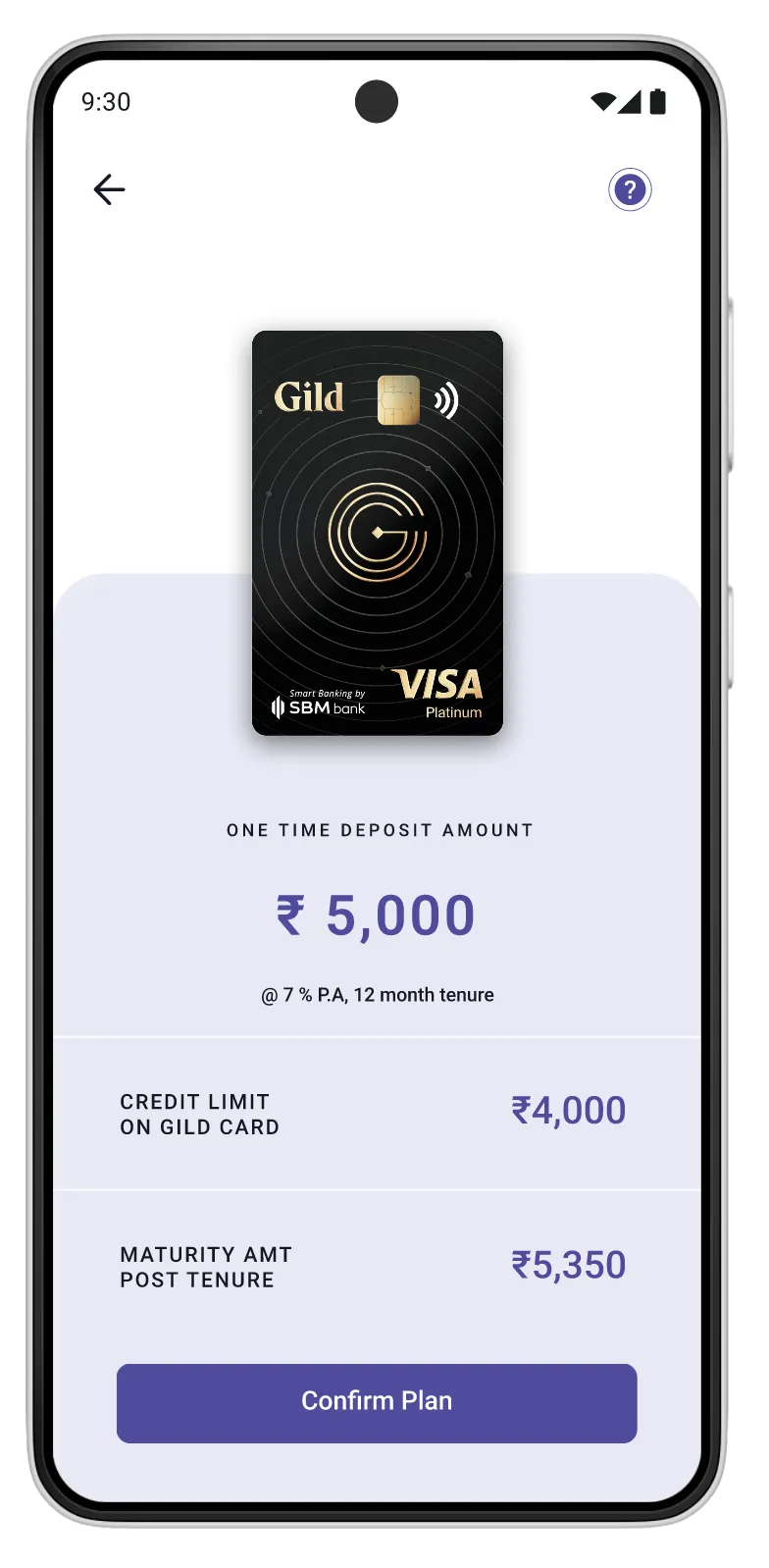

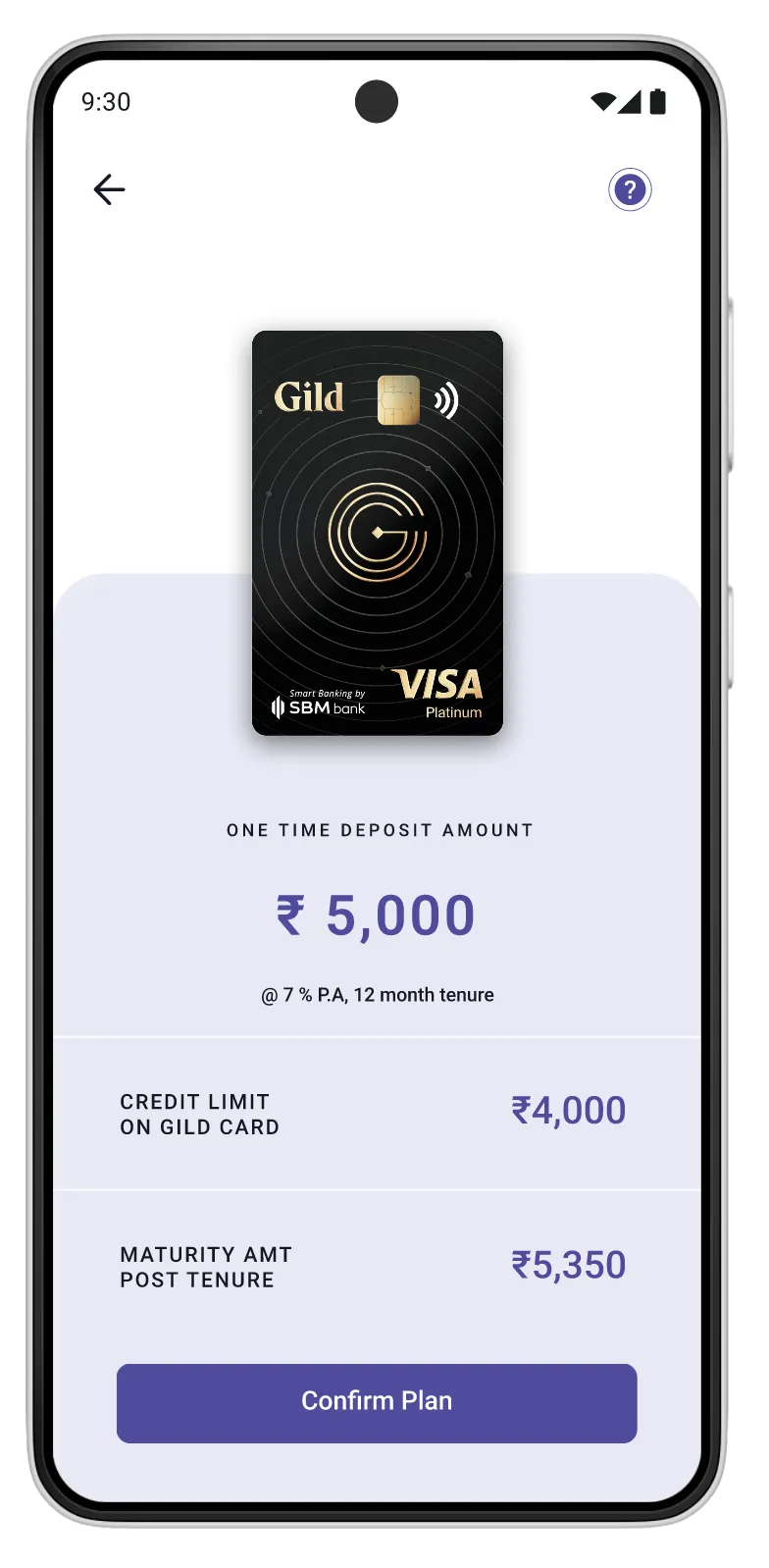

Introducing the Credit Builder App

In February 2022, we launched a dedicated credit-building experience as a strategic solution to our drop-off problem. This wasn't just a feature update—it was a new product offering that transformed how we serve credit-invisible users.

What We Launched

Secured Credit Card Product

FD-backed credit card (ZET SBM) for users with no credit history, enabling them to build creditworthiness from scratch.

Smart Product Hierarchy

Redesigned card selection UI with strategic placement and transparent alternatives to guide without forcing.

Educational Content

In-app guidance explaining credit building, eligibility, and the benefits of secured cards to first-time users.

Launch Strategy

PHASE 1

Pilot with Top Agents

Rolled out to 50 high-performing agents for initial feedback and refinement.

PHASE 2

Gradual Rollout

Expanded to 500+ agents across 3 regions, monitoring conversion and feedback closely.

PHASE 3

Full Launch

Company-wide release to 5,000+ agents nationwide with full marketing support.

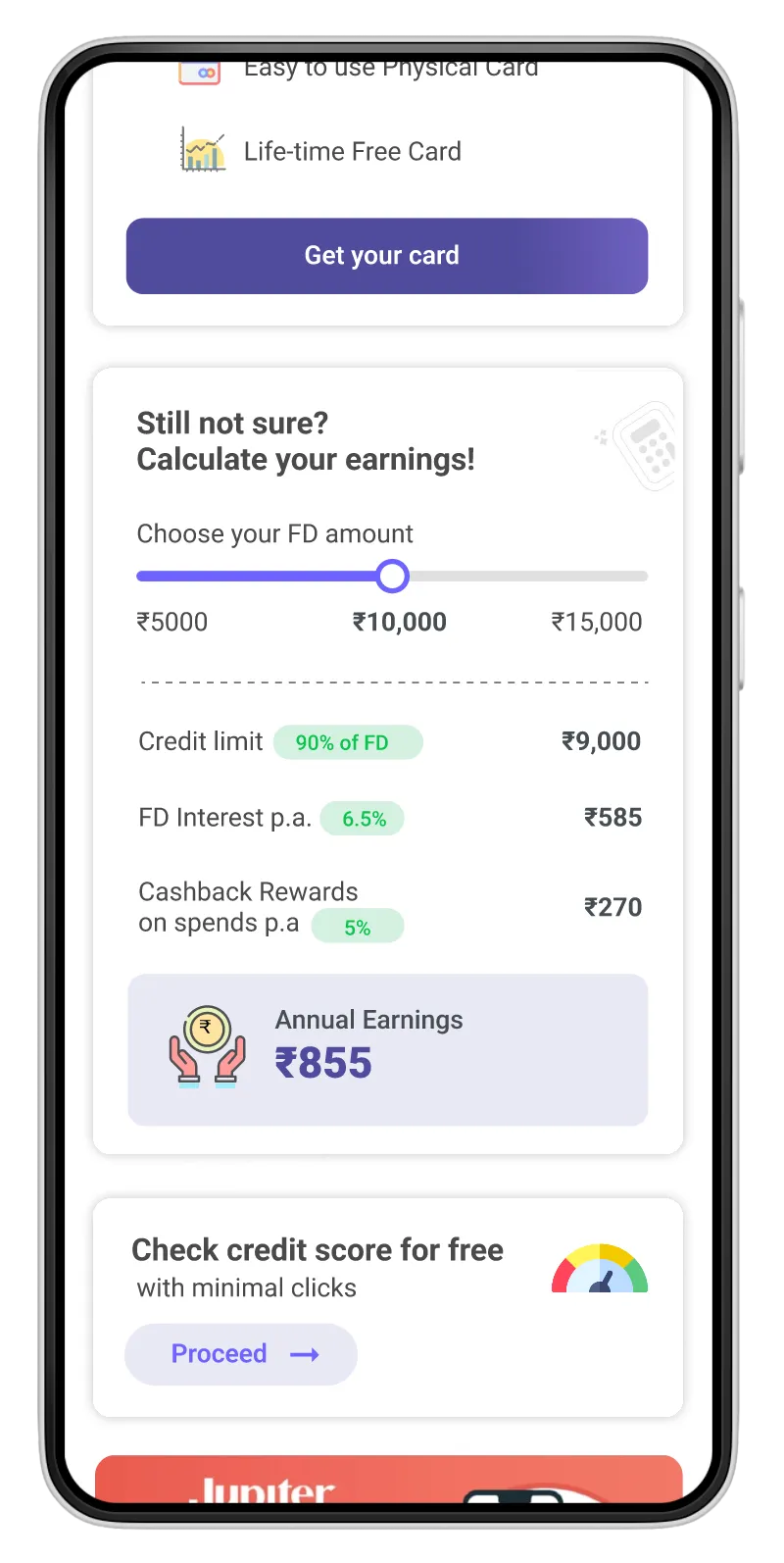

alpha version

D

Version Alpha 4

FD Calculator Focus

Highlighted the FD-backed card calculator and credit score features. This was a step closer to the solution but felt too transactional—missing the educational and trust-building elements.

✓ What Worked

Clear utility value and practical tools

✗ What Didn't

Lacked educational context and trust-building

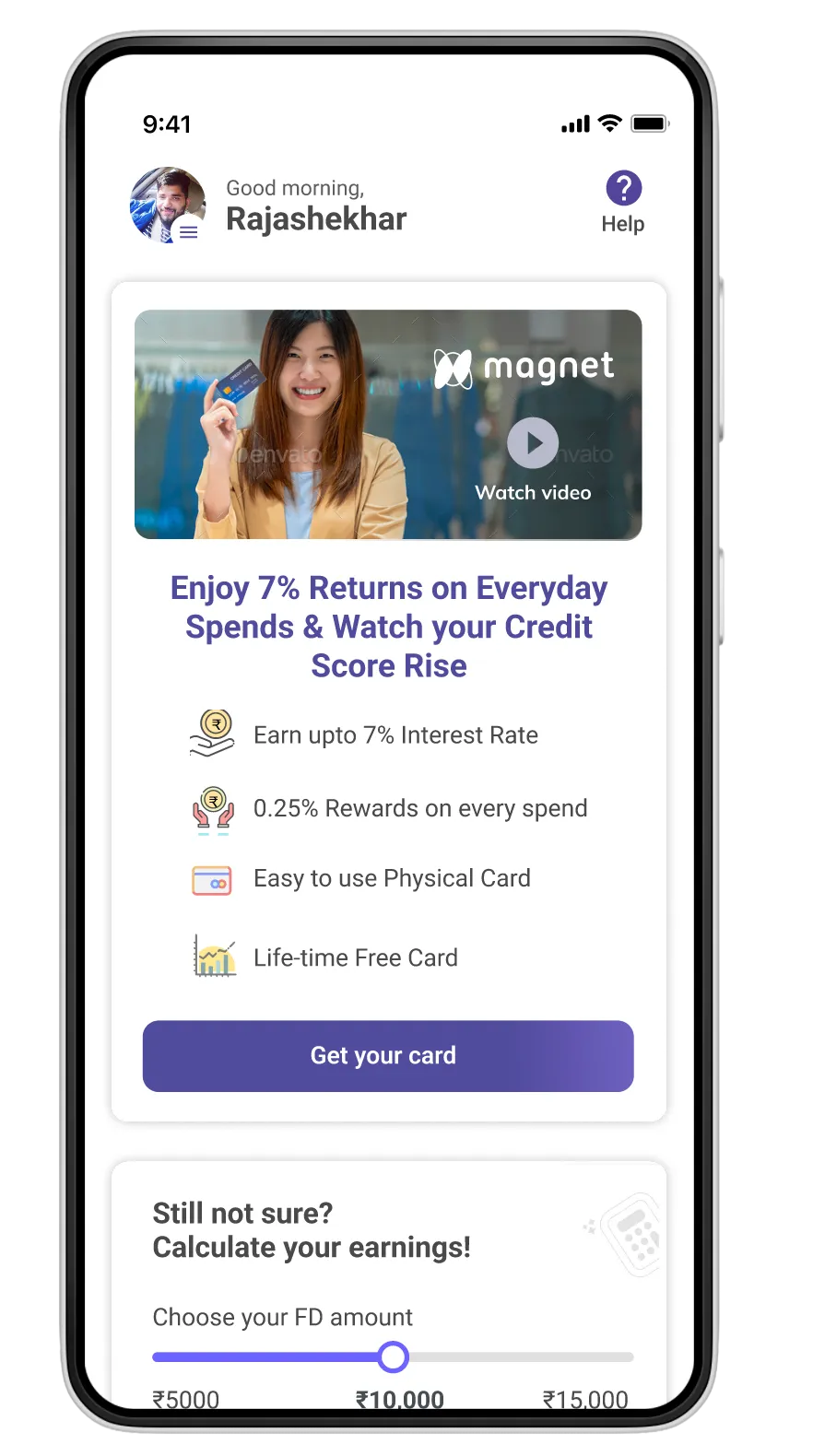

C

Version Alpha 3

Partner Card Hero

Featured partner credit cards (like Magnet) prominently with video content. This tested well but didn't solve the credit-invisible user problem—these users still saw nothing when ineligible.

✓ What Worked

Strong visual hierarchy and clear product focus

✗ What Didn't

Didn't address the core 67% drop-off issue

B

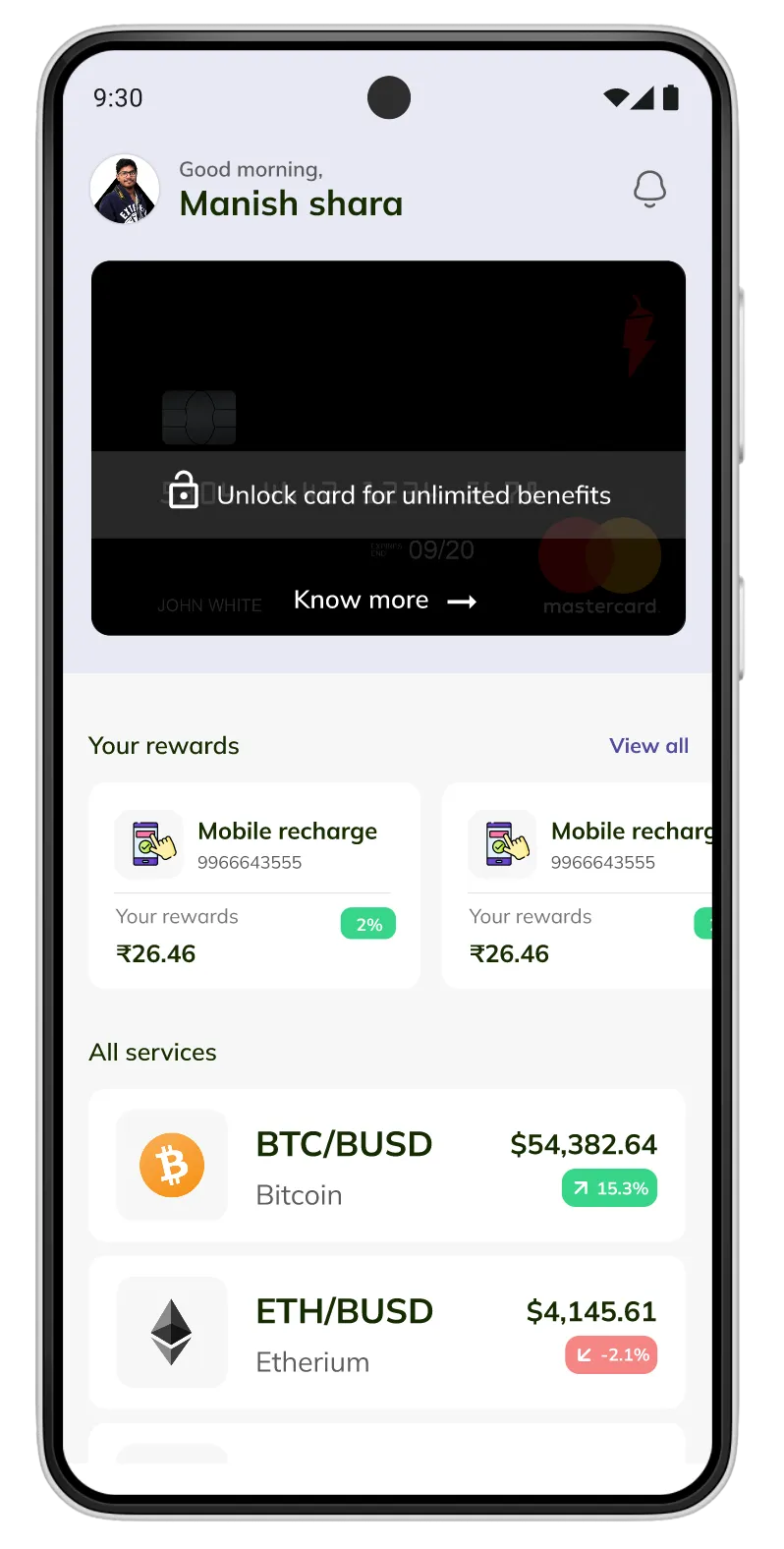

Version Alpha 2

Dark Mode Experiment

Tested a dark interface with icon-based service navigation. Agents found it visually appealing but struggled with icon recognition, especially in rural areas with lower digital literacy.

✓ What Worked

Modern, premium feel that elevated brand perception

✗ What Didn't

Icon comprehension issues in rural markets

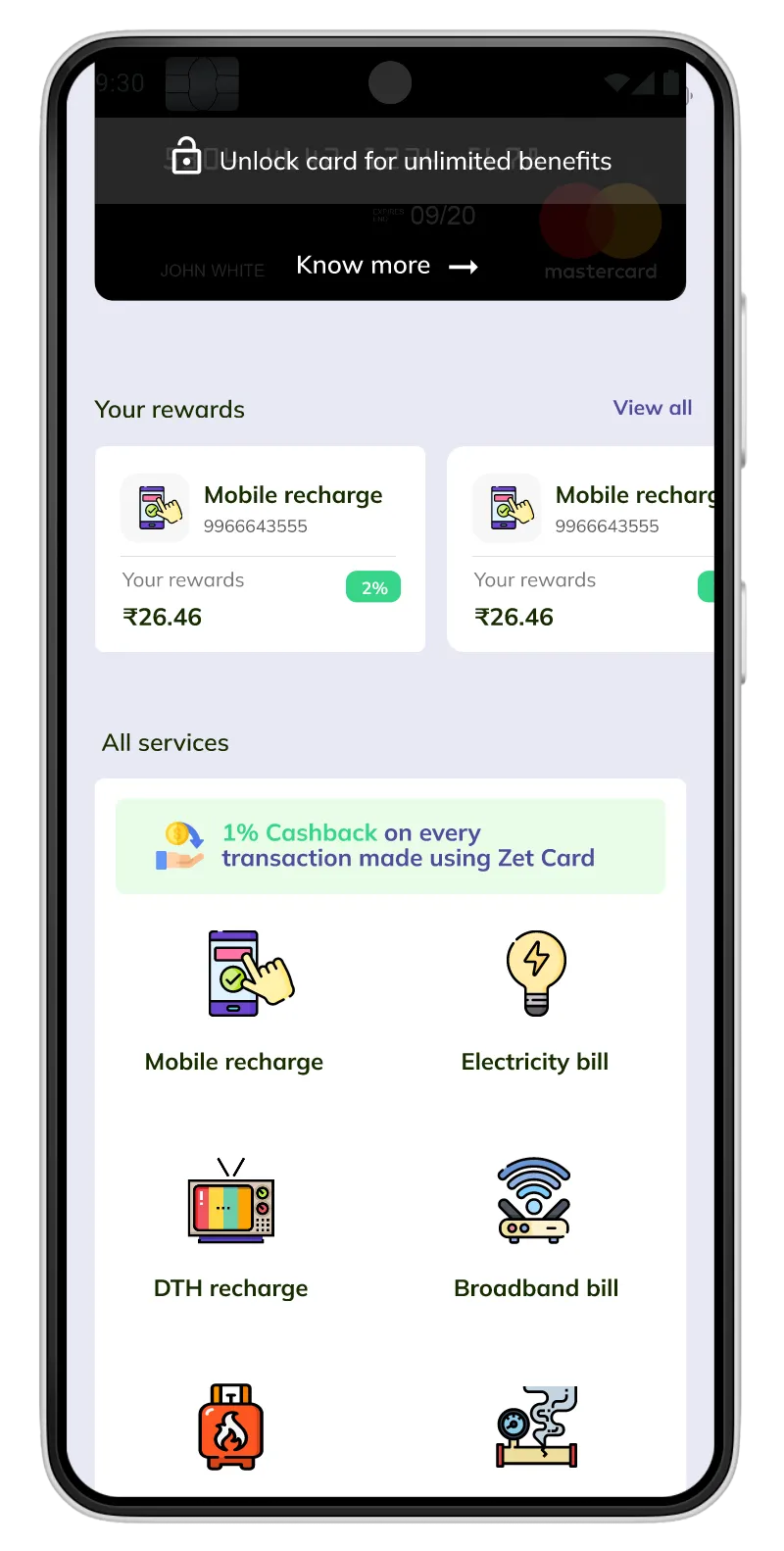

A

Version Alpha 1

Rewards-First Approach

Emphasized user rewards and benefits at the top of the home screen. While this created excitement, it buried the core financial services too deeply in the hierarchy.

✓ What Worked

Strong emotional engagement and excitement around benefits

✗ What Didn't

Core services not immediately visible to agents

Early Explorations & Alpha Designs

Before arriving at the final credit-builder solution, we explored multiple interface concepts and information architectures. These alpha versions helped us test different approaches to card presentation, rewards integration, and financial services hierarchy.

Alpha Design Iterations

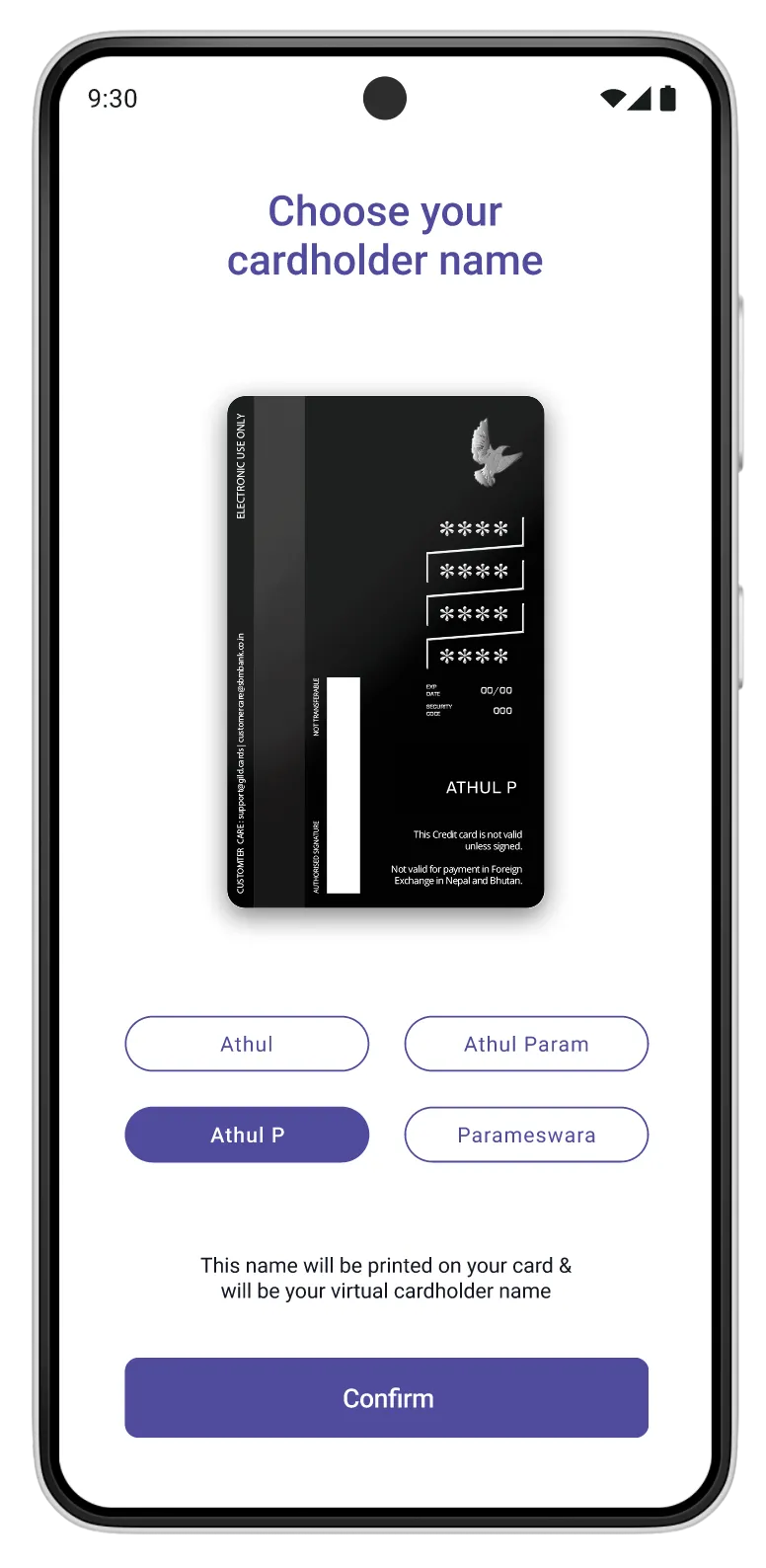

final designs

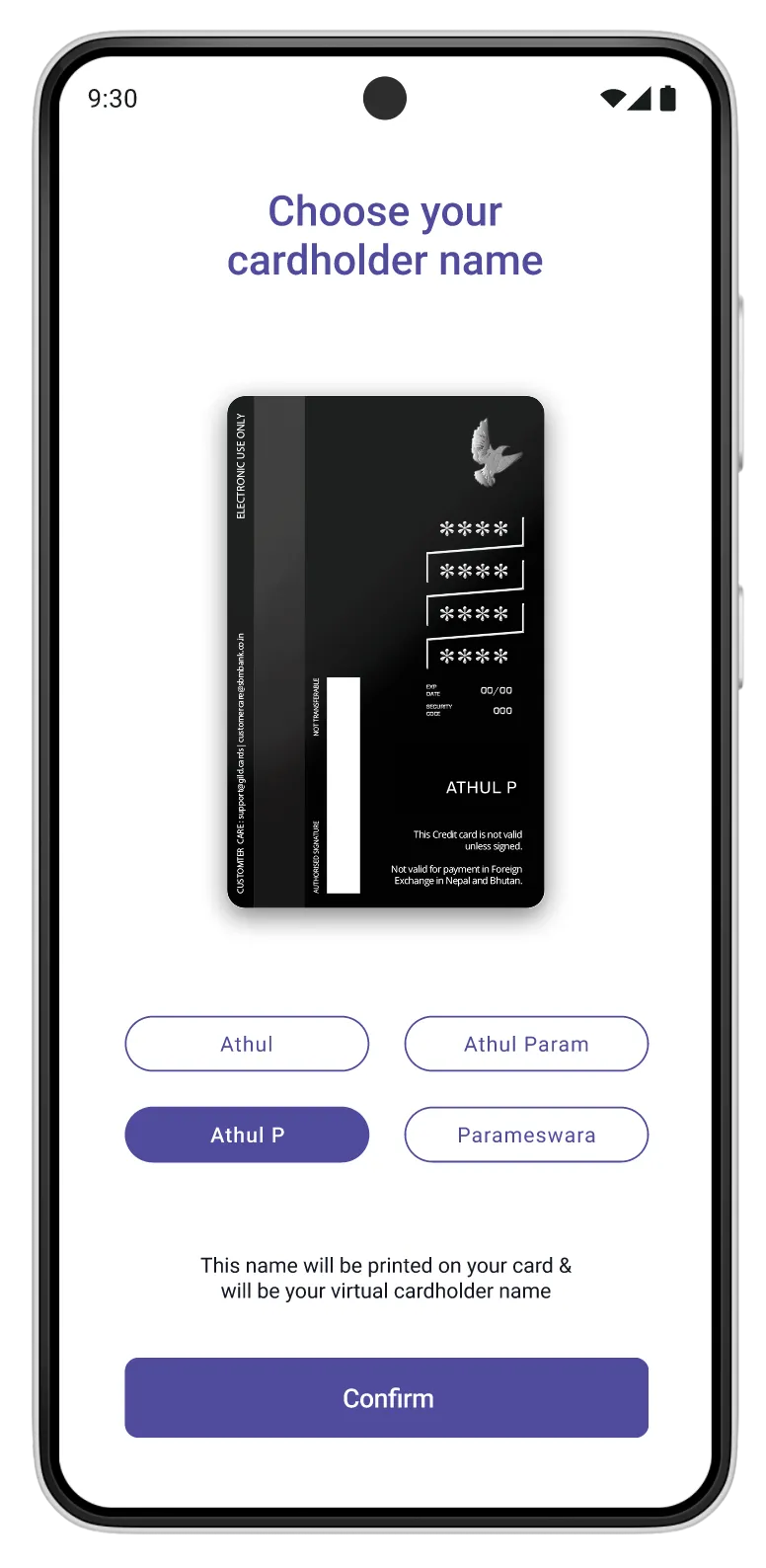

After extensive research, testing, and iteration, we launched the final credit builder application. This solution seamlessly integrated into the agent workflow while providing a clear path for credit-invisible users to build their financial future.

The Complete Credit Builder Experience

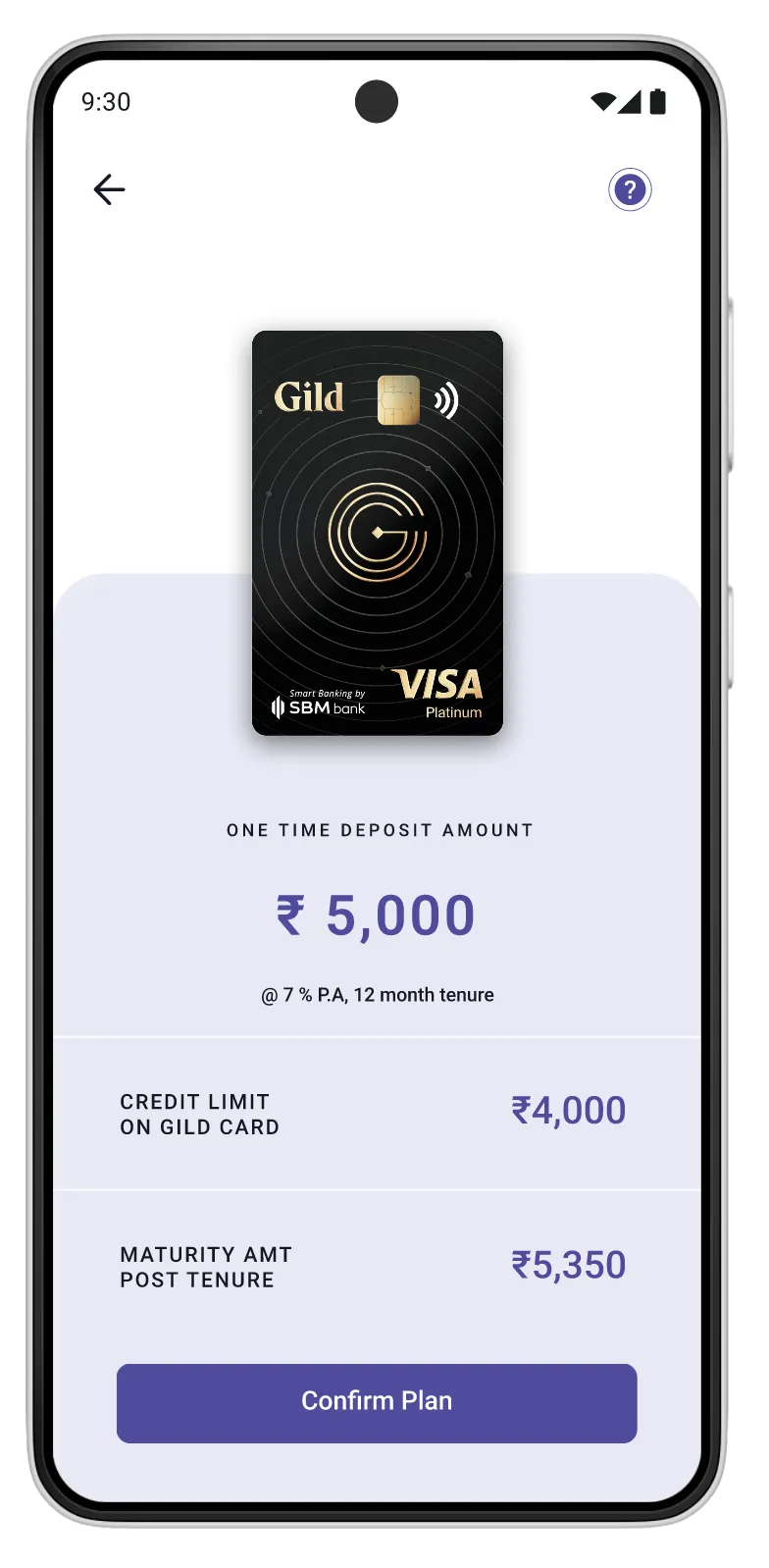

1

Card Selection

Choose Your FD-Backed Card

Users select their desired credit limit which determines the FD amount needed. The interface clearly breaks down the FD deposit, joining fee, and resulting credit limit—eliminating confusion and building trust through transparency.

Design Focus

Clear pricing breakdown with no hidden fees

User Benefit

Informed decision-making from the start

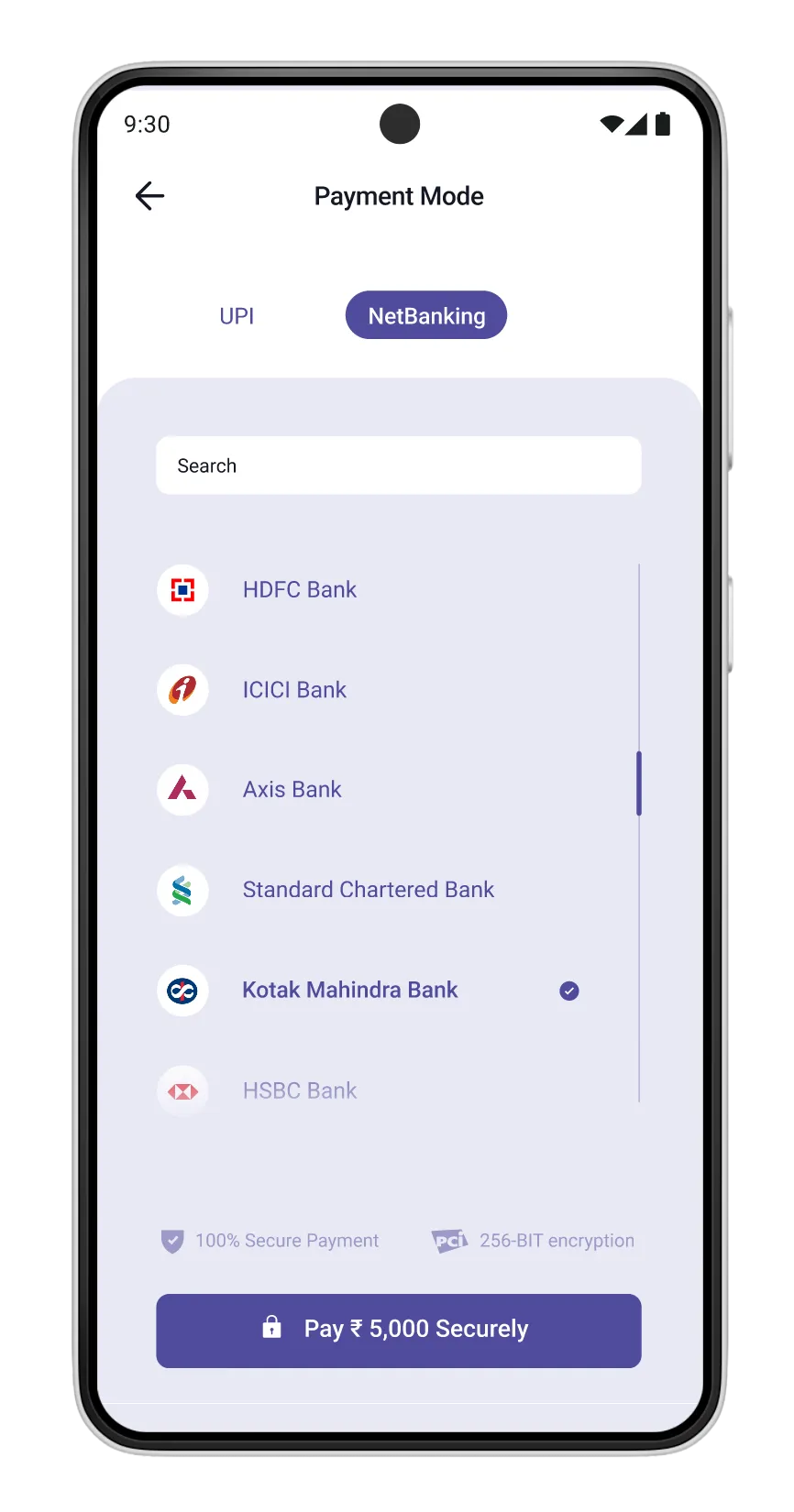

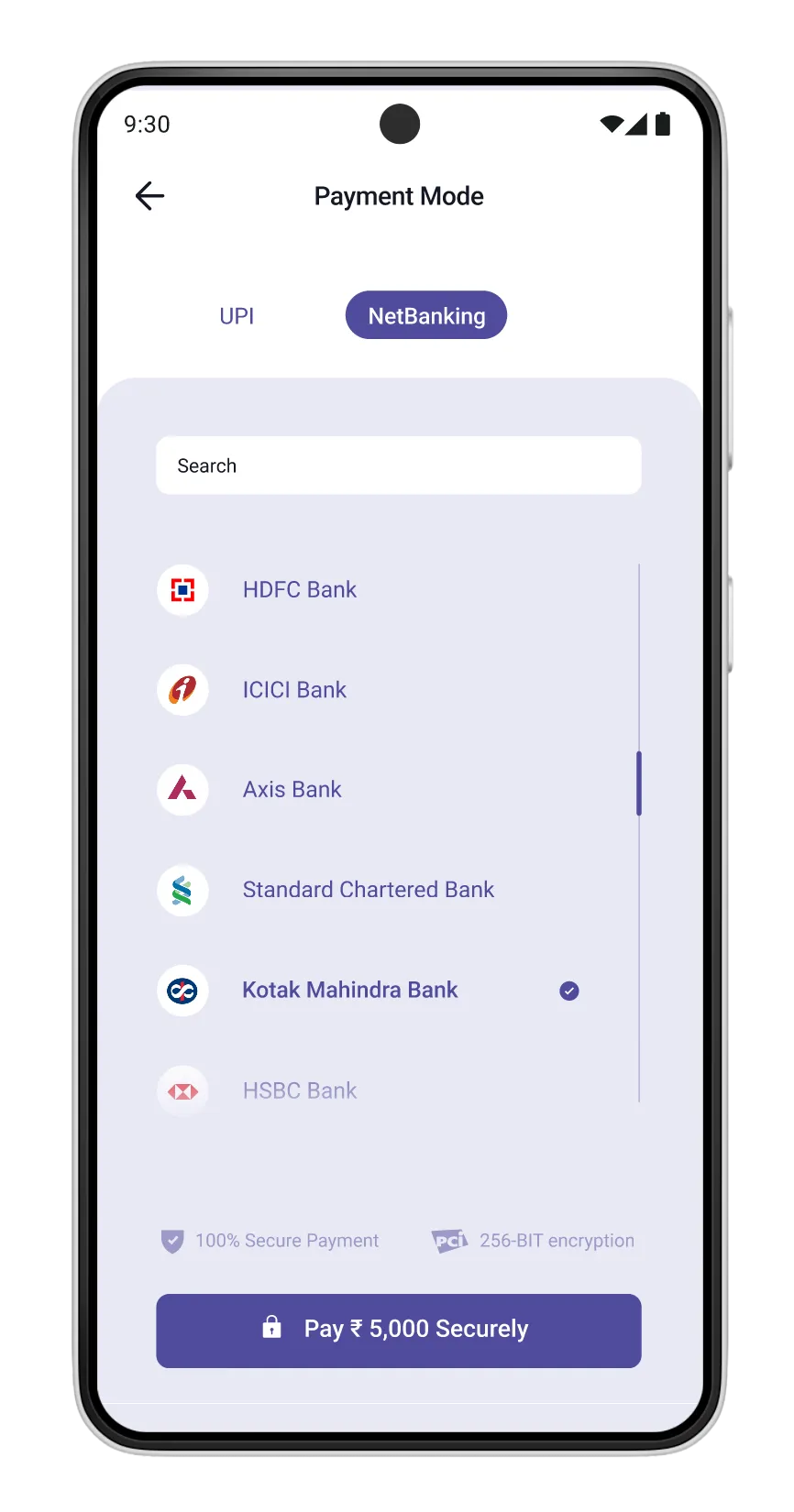

2

Payment Mode

Select Your Bank for FD Creation

Users choose their preferred bank partner for the fixed deposit. This flexibility respects user preferences while maintaining seamless integration with multiple banking partners.

Design Focus

Multiple bank options with clear logos

User Benefit

Choice and control over banking partner

3

Account Setup

Seamless Bank Account Creation

The system guides users through opening a savings account with their chosen bank if they don't have one. This step is crucial for FD creation and is presented as a natural part of the journey.

Design Focus

Minimal friction onboarding flow

User Benefit

One-stop solution for all requirements

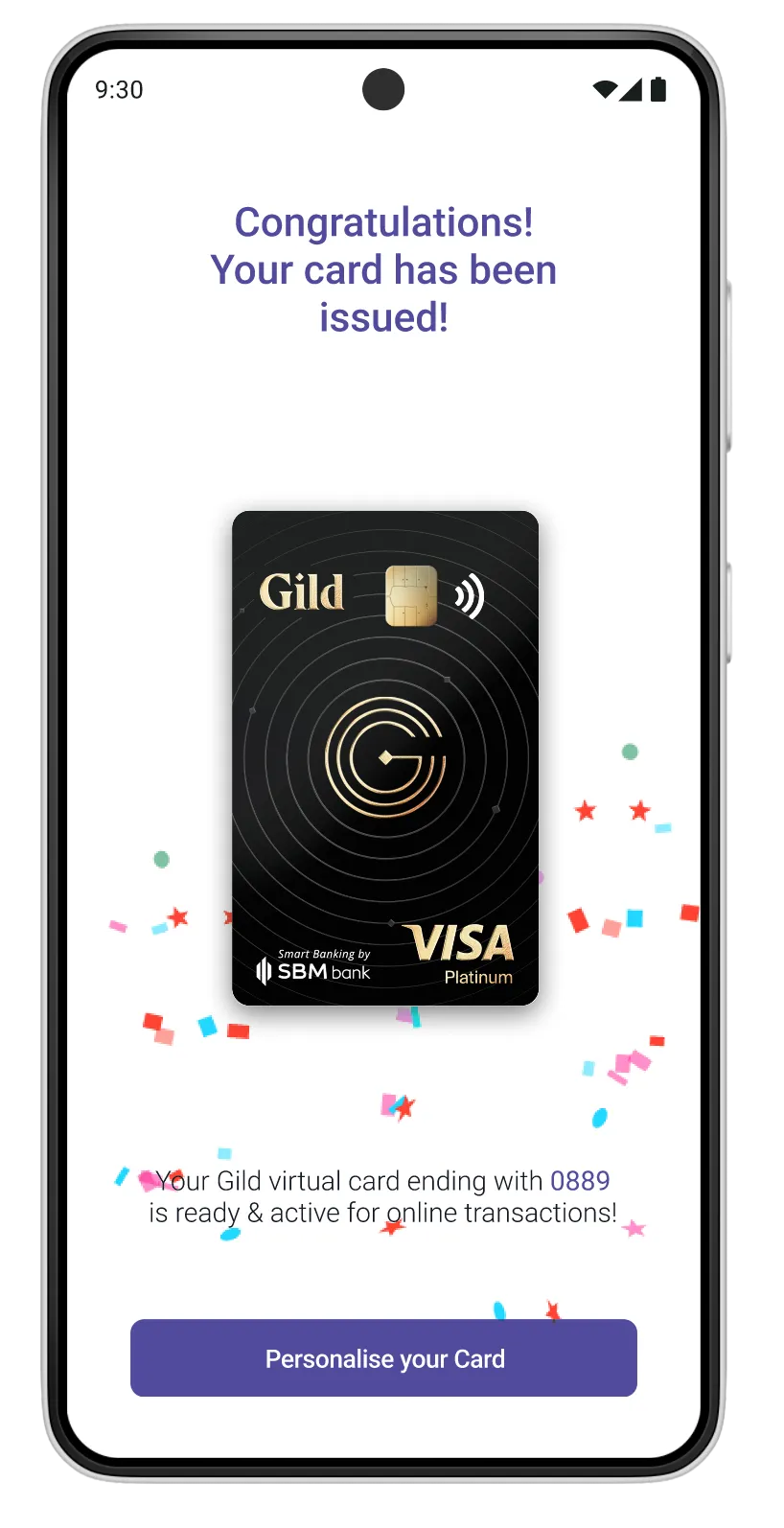

4

Application Success

Application Complete

A clear success screen reassures users their application is submitted and sets expectations for what happens next. The timeline and next steps prevent anxiety during the approval wait period.

Design Focus

Clear confirmation and timeline

User Benefit

Peace of mind with clear expectations

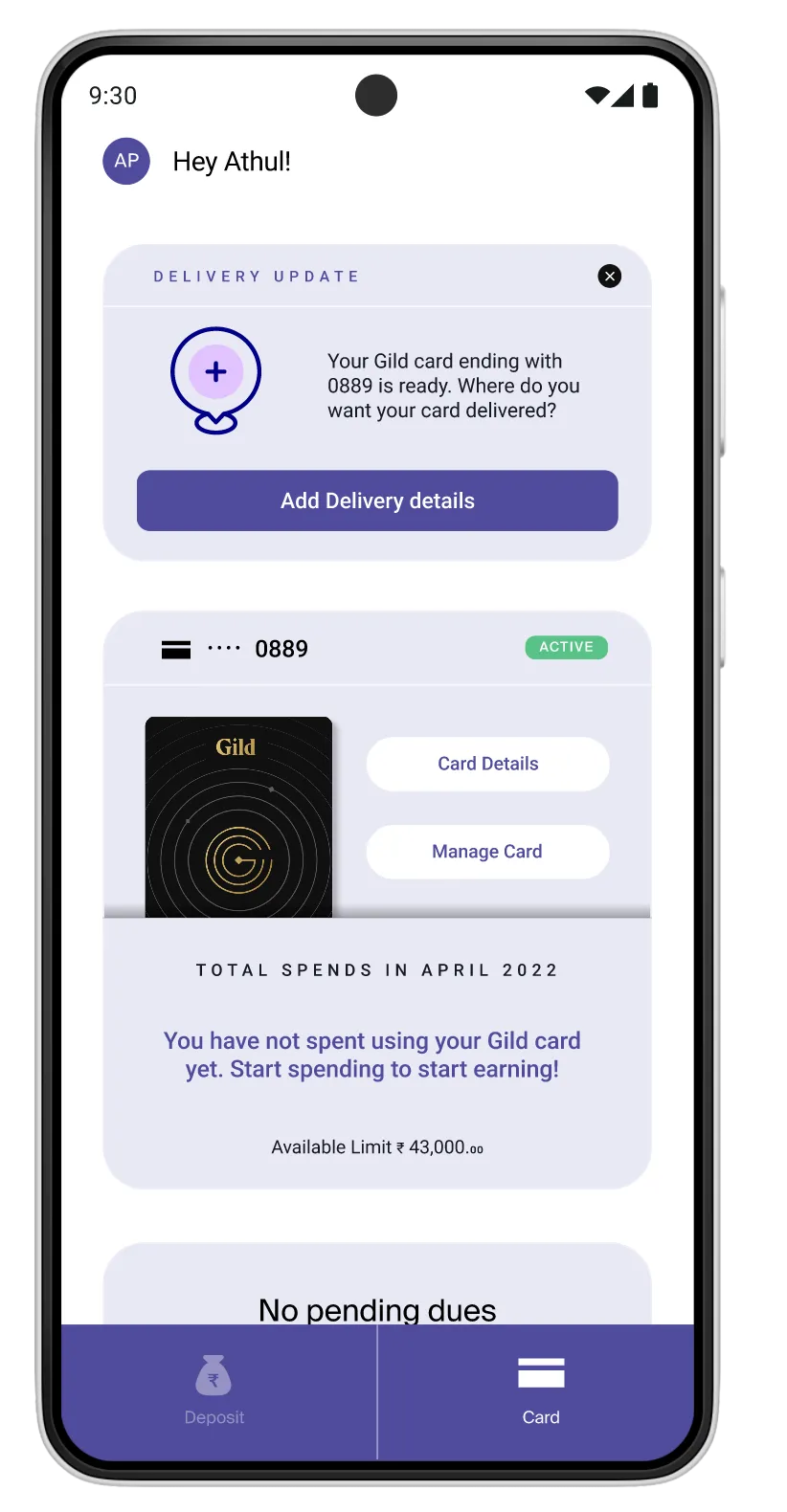

5

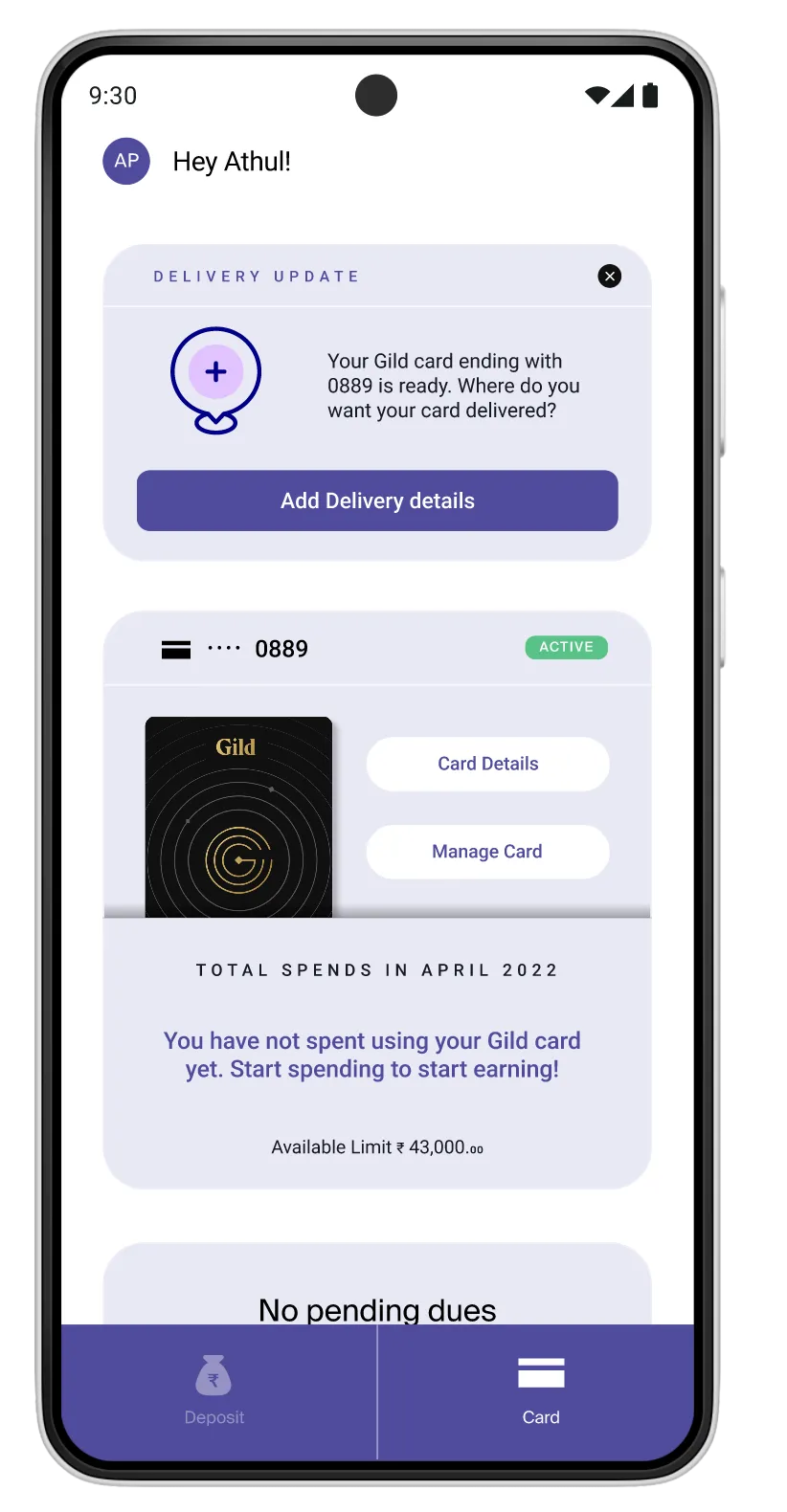

Delivery Tracking

Track Your Card Delivery

Real-time tracking keeps users informed about their card's journey. The visual timeline shows progress from approval to dispatch to delivery, reducing anxiety and support queries.

Design Focus

Visual progress with status updates

User Benefit

Transparency reduces support burden

6

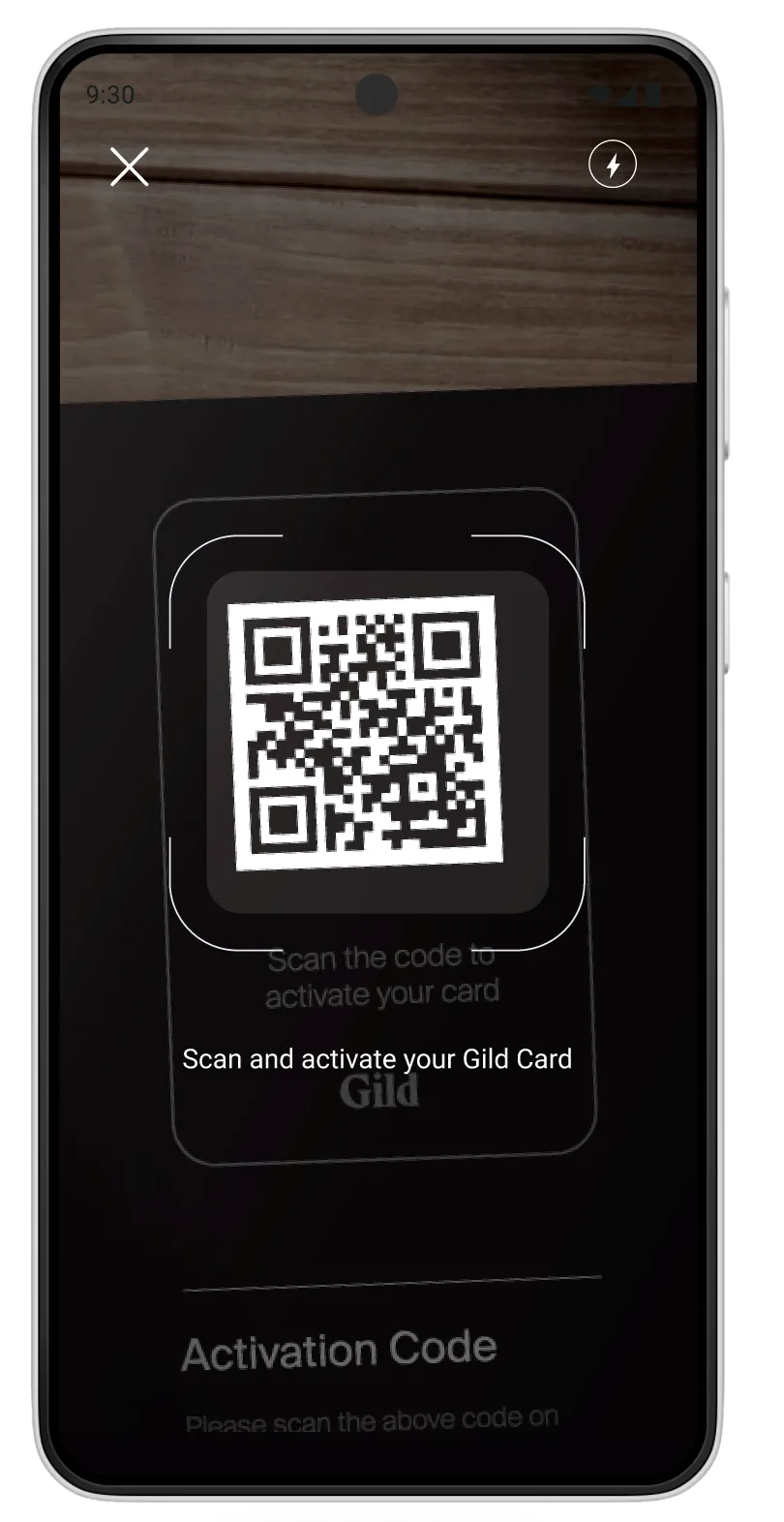

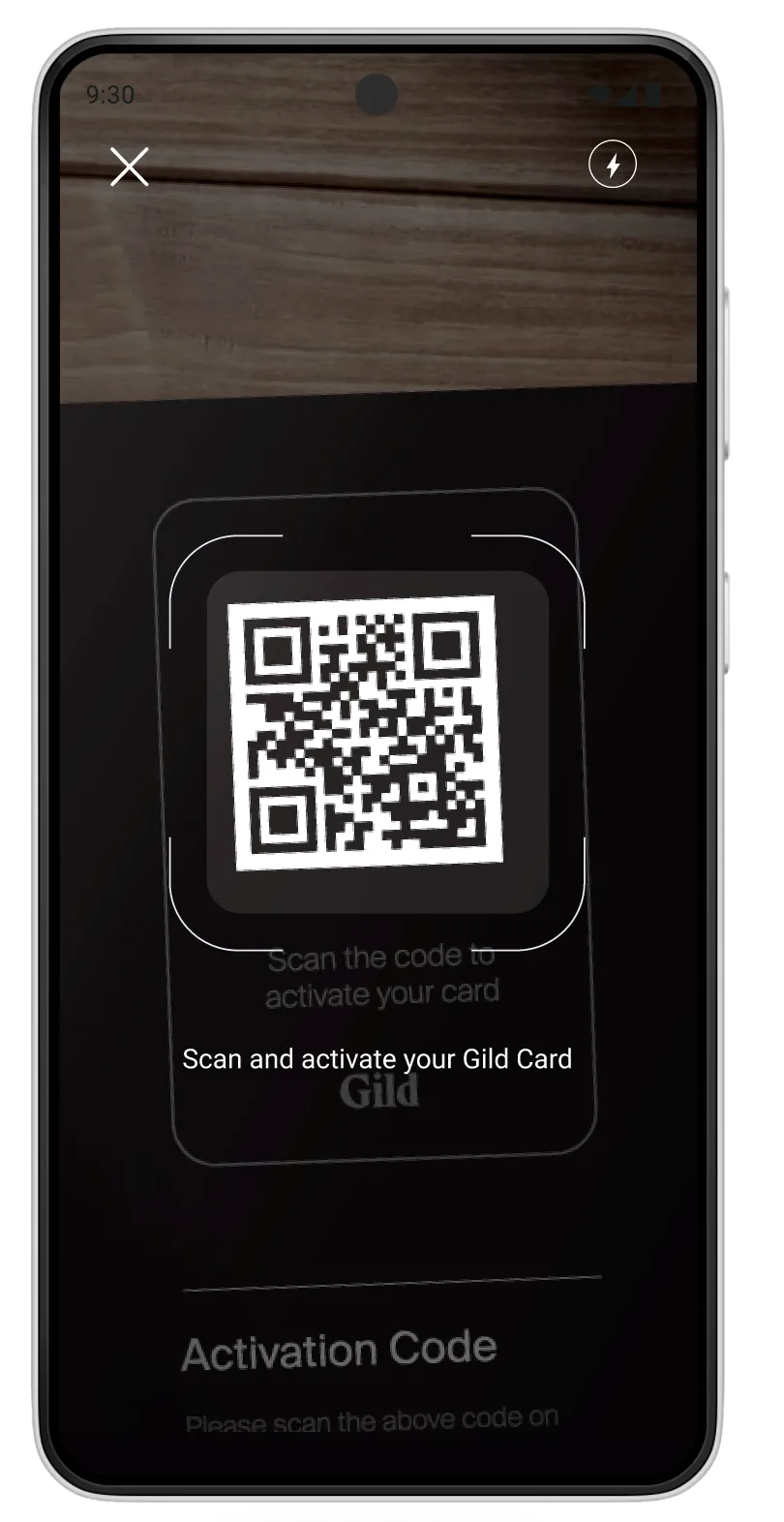

Card Activation

Quick QR Code Activation

Simple QR code scanning eliminates the need to manually enter long card numbers. This modern activation method is intuitive for agents and reduces errors during the setup process.

Design Focus

QR scan for quick activation

User Benefit

Error-free activation in seconds

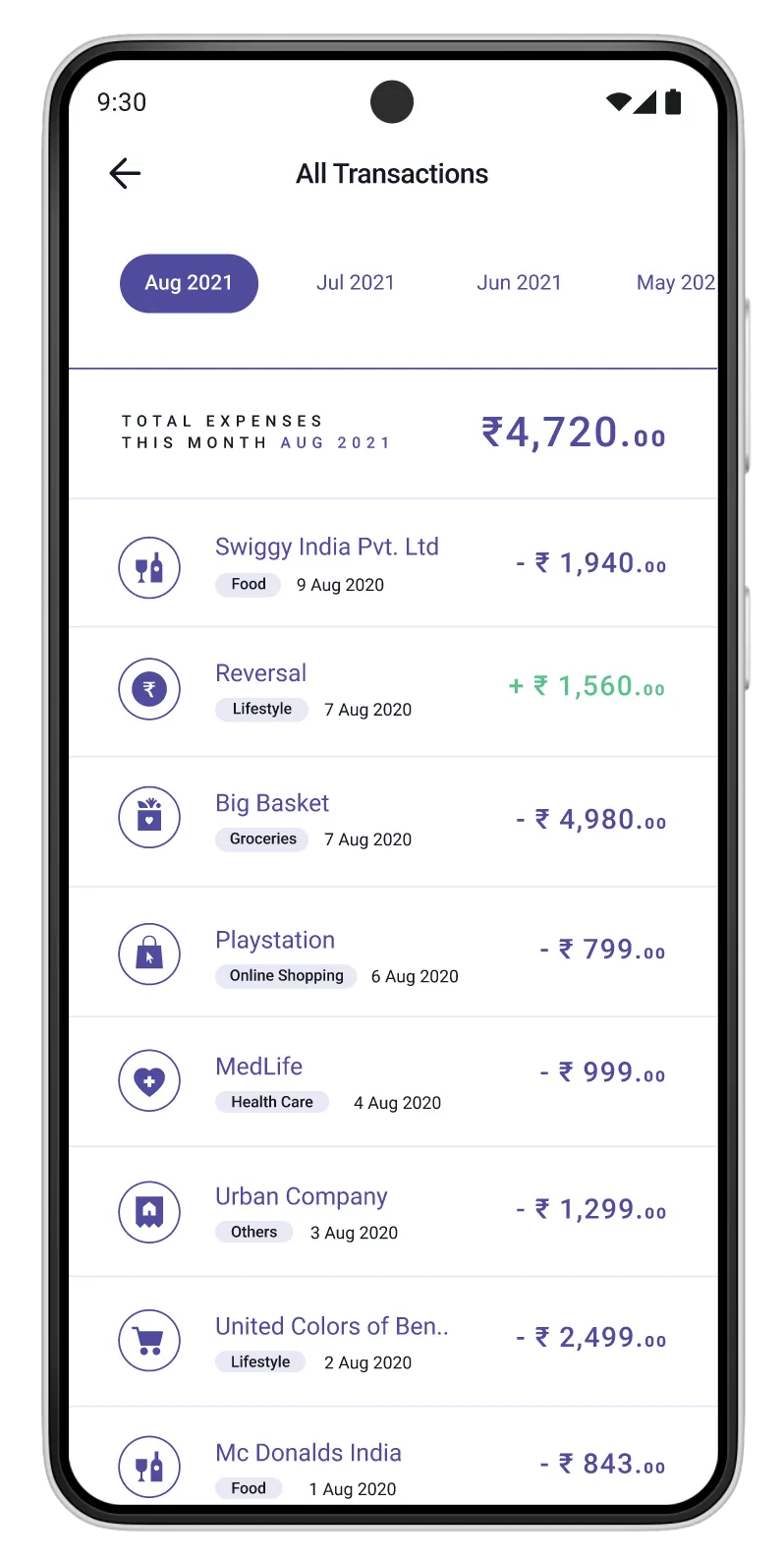

7

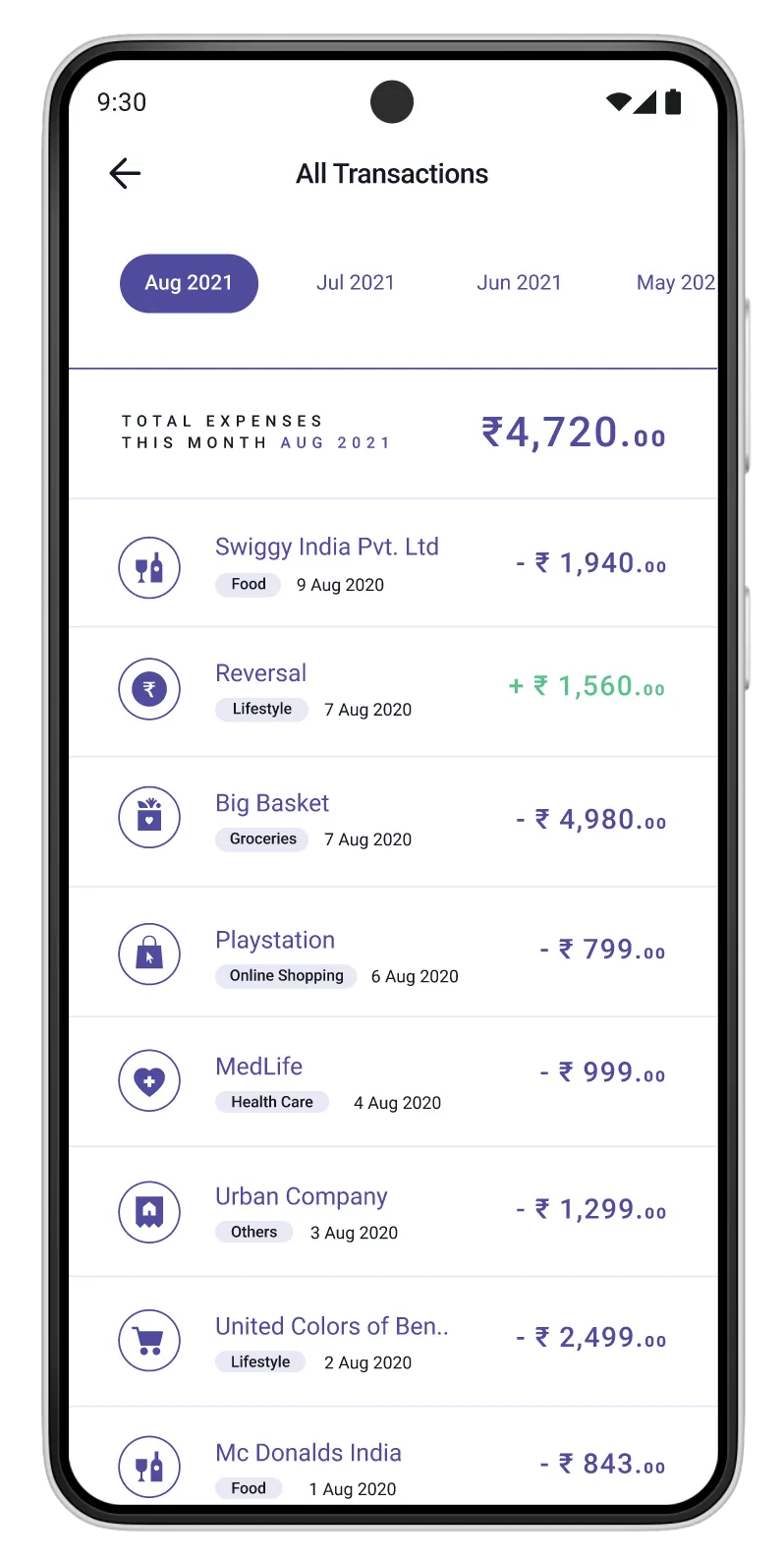

Transaction History

Complete Spending Overview

Users can view all their transactions with clear categorization and spending patterns. This visibility helps them understand their credit usage and builds financial awareness—key to long-term credit health.

Design Focus

Chronological list with categories

User Benefit

Financial awareness and control

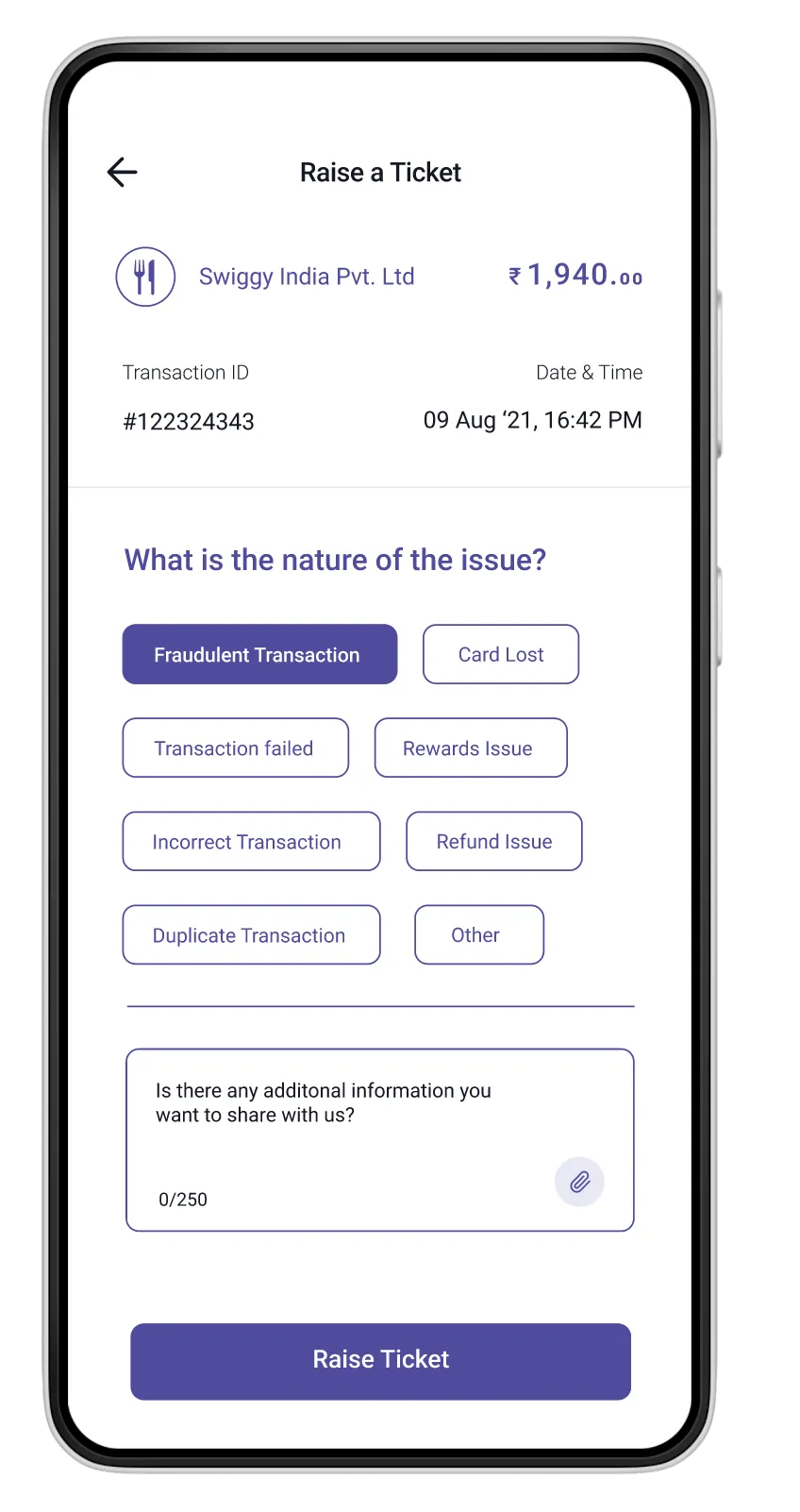

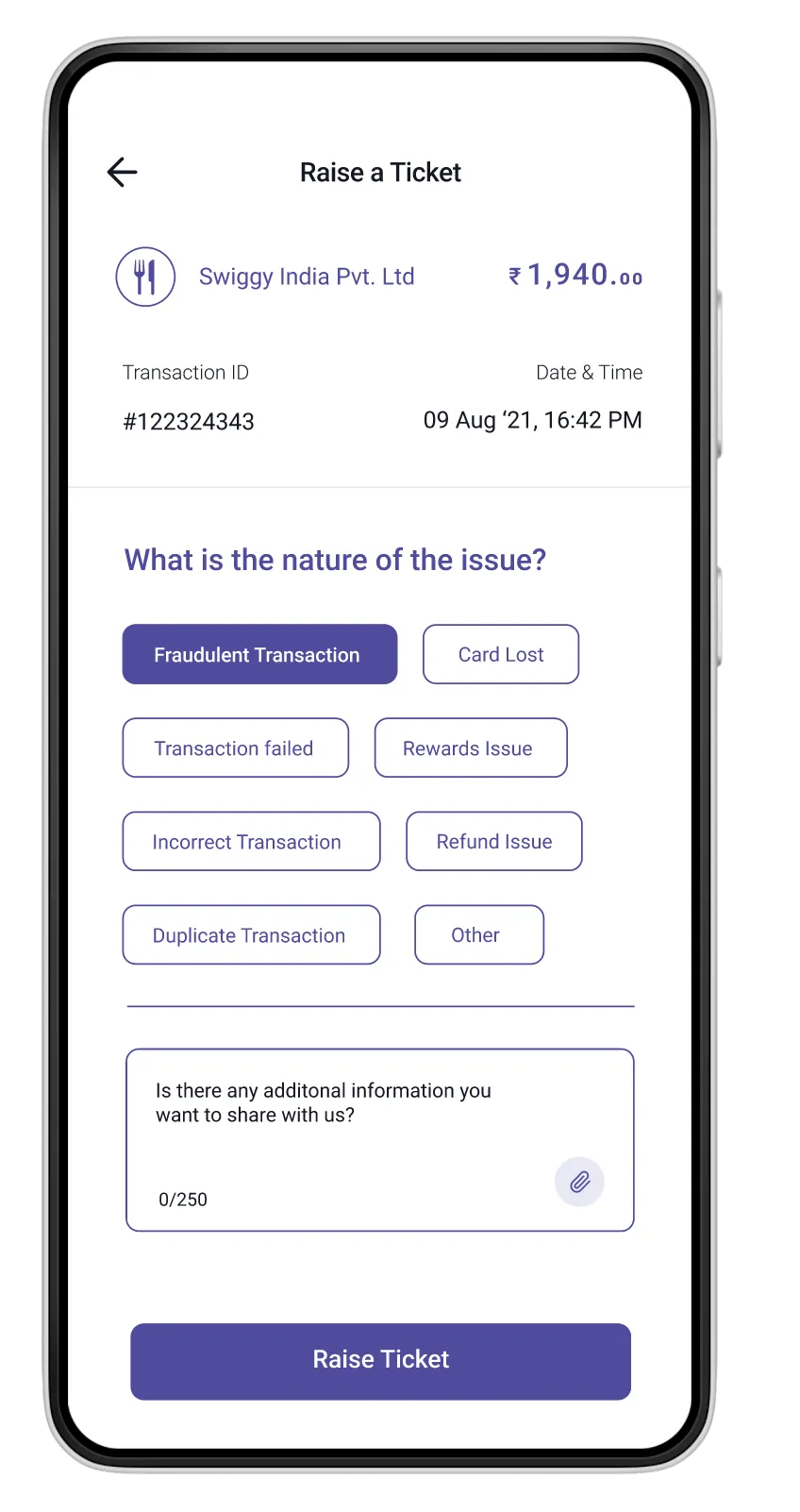

8

Support Center

Integrated Support System

Built-in support with categorized issue types makes it easy for users to get help when needed. The ticket system ensures accountability and tracks resolution, building confidence in the platform.

Design Focus

Categorized issues with ticket tracking

User Benefit

Quick resolution and accountability